We believe the best option is to focus on traditional technical trading indicators and price action strategy. What is the best option for retail traders (instead of wasting your time on a limit order book trading strategy)?

We have explained why in the linked articles below: The limit order book trading strategy is way too similar to high-frequency trading and scalping – two trading methods we believe are a waste of time for 99.5% of all retail traders.

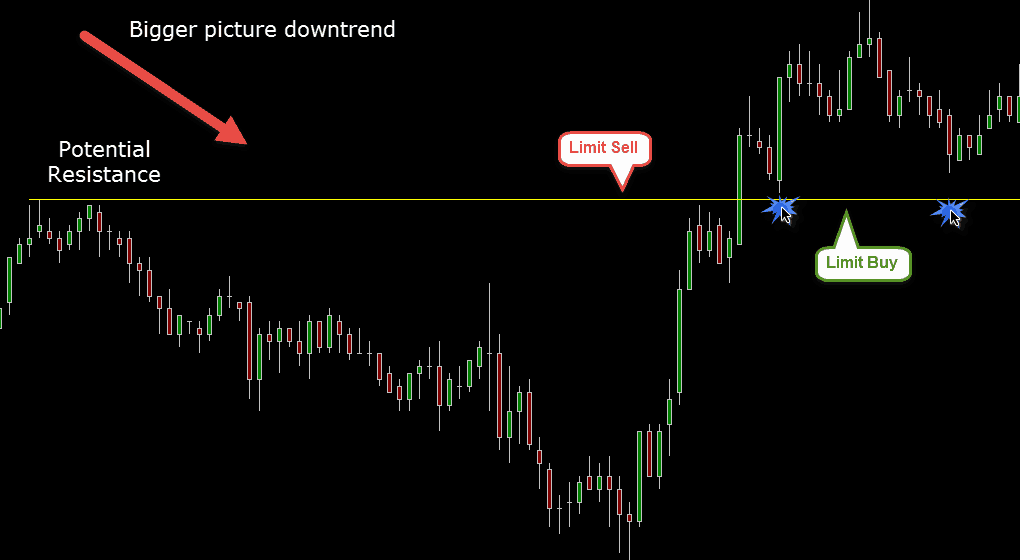

First, it’s extremely difficult to backtest.We would love to provide you with a limit order book trading strategy, but unfortunately, we don’t. Limit order book trading strategy backtest – does it work? If a buy market order comes in, it matches the lowest sell limit order (ask) that came in the earliest. If a sell market order comes in, it matches the highest buy limit order (bid) that came in the earliest. The most common matching mechanism uses the price-time priority. Limit order book example What is an order book algorithm?Īn order book algorithm is a matching algorithm in the order book that matches the incoming market order to the right limit order in the order book. On the ask (sell limit orders) side, prices are arranged from lowest to highest and according to time.On the bid (buy limit orders) side, prices are arranged from highest to lowest and according to the time the orders came in.In an order book, limit orders are arranged by the exchange on a price-time priority, such that the best prices are kept at the top, as follows: The huge order would be able to absorb further orders and prevent the price from moving aggressively against your position.Your order would get filled before the huge order.It is best to set your order at a level a little before a huge order. To trade effectively with limit orders, you need to monitor the order book to know the right price to set your limit order. For example, if huge sell orders are coming in at lower prices, and the buy side is scanty, there’s a huge chance the price would drop. If you are a day trader or a scalper, you can trade based on the limit order books by tracking the order flow. By watching the changes in order flow, you can predict short-term price changes. To trade based on limit order books, you need to understand the concept of order flow and how it determines supply and demand imbalances. How do you trade based on limit order books? The sell limit orders (Asks or Offers) - from the lowest to the highest prices.The buy limit orders (Bids) - from the highest to the lowest prices.The order book is typically grouped into: The trade size - in the case of a stock, the number of shares to buy or sell.The order direction - a buy order or a sell order.

Every limit order someone submits to an exchange will be displayed on the order book with the following information: The limit order book trading strategy is simply trading based on the order flow.Īn example in Tradingview of a limit order book.Įach exchange maintains an order book for every security listed on it. What is a limit order book trading strategy?Ī limit order book (LOB), also known as the central limit order book (CLOB) is an electronic bookkeeping system maintained by an exchange, which shows all buy and sell limit orders that come in for a given instrument - stocks, futures, bonds, cryptocurrencies, etc. How can I get started with limit order book trading?.What are the risks associated with limit order book trading?.What are the advantages of limit order book trading?.How does limit order book trading work?.Limit order book trading strategy backtest – does it work?.How do you use limit orders effectively?.How do you trade based on limit order books?.What is a limit order book trading strategy?.

0 kommentar(er)

0 kommentar(er)